When you think about factors that influence your warehouse insurance costs, what comes to mind? Fire suppression systems? Security measures? Employee safety protocols? While these are certainly important, there’s one overlooked element sitting right under your inventory that could be quietly driving up your premiums: your pallets.

Yes, those wooden platforms stacked in every corner of your facility might be costing you far more than their purchase price. Let’s dive into the surprising connection between pallet management and insurance costs, and more importantly, what you can do about it.

Table of Contents

ToggleThe Hidden Connection Between Pallets and Insurance Risk

Insurance companies assess risk based on dozens of factors, and many warehouse managers don’t realize that pallet condition and storage practices fall squarely into that assessment. Underwriters aren’t just looking at your sprinkler systems and loading dock safety—they’re evaluating everything that could potentially cause an accident, fire, or product loss.

Damaged, improperly stored, or poorly maintained pallets represent significant liability exposures. A broken pallet can lead to forklift accidents, fallen inventory, worker injuries, and, in worst-case scenarios, catastrophic fires. Each of these incidents doesn’t just cost you in immediate damages; they create a claims history that follows your business and influences future premium calculations.

Fire Hazards: The Most Serious Pallet-Related Risk

Here’s a sobering fact: wood pallets are essentially kindling waiting for an ignition source. When stored improperly, they create what fire safety experts call a “high fuel load”—a concentration of combustible material that can turn a small spark into a raging inferno within minutes.

Fires involving wooden pallets burn extremely hot and spread rapidly. The porous nature of wood allows flames to travel quickly both horizontally and vertically, especially when pallets are stacked high or stored too close together. Fire marshals and insurance inspectors specifically look for pallet storage violations during facility inspections because they know how devastating these fires can be.

Consider this: a warehouse fire attributed to pallet storage issues doesn’t just damage your property. It creates an insurance claim that could range from hundreds of thousands to millions of dollars, depending on inventory value and building damage. Even if you recover from the fire, your insurance history now includes a major claim that will impact your premiums for years to come.

Common Pallet Storage Violations That Raise Red Flags

Insurance inspectors and fire marshals have seen it all when it comes to dangerous pallet practices. Here are the most common violations that immediately signal higher risk to insurers:

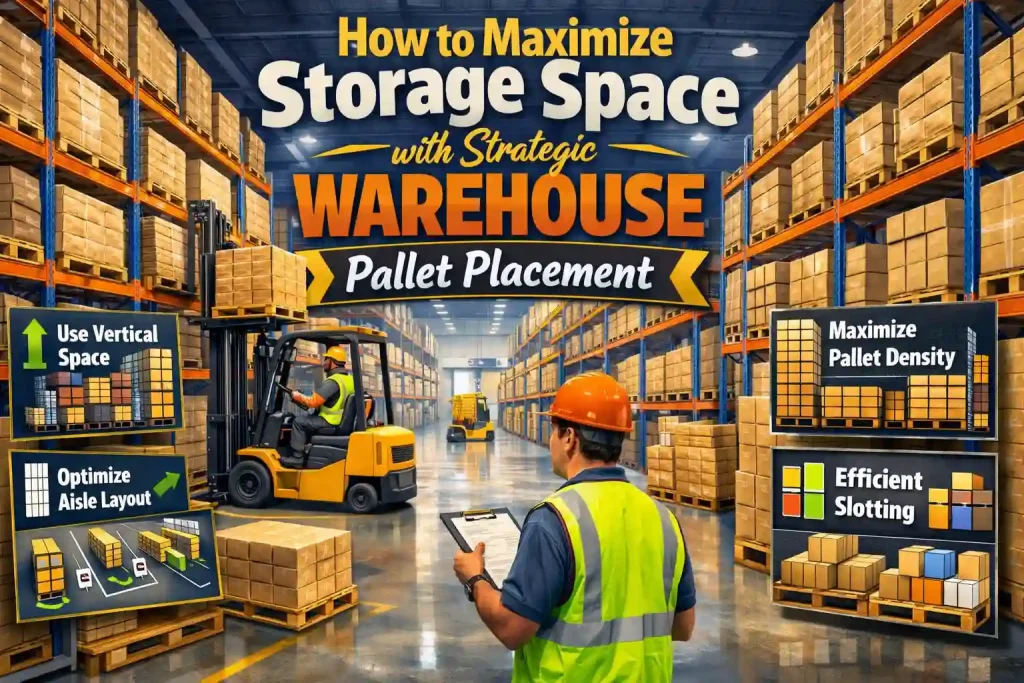

Excessive vertical stacking creates unstable towers of combustible material. While it might seem like an efficient use of vertical space, stacking pallets more than 6 feet high without proper separation significantly increases fire spread risk.

Inadequate clearance from heat sources is another frequent issue. Pallets stored too close to heaters, electrical panels, or other potential ignition sources give insurers serious pause. Industry standards typically require at least 8 feet of clearance from heating equipment.

Blocking fire suppression systems might seem obvious, but it happens more often than you’d think. Pallets stored beneath sprinkler heads or in front of fire extinguisher stations directly compromise your facility’s emergency response capabilities.

Poor housekeeping practices surrounding pallet areas compound the risk. Debris, sawdust, plastic wrap remnants, and broken pallet pieces create additional fuel for fires and contribute to an overall impression of inadequate safety management.

How Damaged Pallets Create Liability Exposures

Beyond fire risk, the condition of your warehouse pallet inventory directly impacts your liability insurance costs. Every damaged pallet in your facility is a potential accident waiting to happen.

Broken boards, protruding nails, and unstable structures cause forklift operators to make sudden adjustments that can lead to tipping, falling loads, or collisions. When a forklift driver encounters an unexpected obstacle because of pallet failure, split-second reactions often result in accidents that could have been entirely prevented.

Worker’s compensation claims stemming from pallet-related injuries add up quickly. A forklift operator injured when a damaged pallet causes a load to shift, a warehouse worker who steps on a broken pallet board, or a team member struck by falling inventory due to pallet failure—these incidents create claims that directly impact your insurance experience modification rate (EMR).

Your EMR is essentially your company’s safety report card. The more claims you have, the higher your EMR climbs, and the more you pay for insurance across the board. Even relatively minor injuries can trigger claims that affect your rates for three years or more.

The Cost of Non-Compliance and Failed Inspections

Insurance companies don’t just assess risk at policy inception—they conduct ongoing inspections and require compliance with safety standards throughout your coverage period. Failing these inspections can have immediate financial consequences.

Many commercial insurance policies include clauses that allow insurers to increase premiums, reduce coverage, or even cancel policies if serious safety violations aren’t corrected within a specified timeframe. Pallet storage violations are frequently cited deficiencies that trigger these actions.

Beyond insurance implications, OSHA violations related to pallet safety carry their own financial penalties. While OSHA doesn’t have specific pallet standards, they enforce general duty requirements under the Materials Handling and Storage regulations. Citations can range from hundreds to thousands of dollars per violation, and serious violations can trigger follow-up inspections that scrutinize every aspect of your operation.

The True Cost of “Cheap” Pallet Solutions

It’s tempting to save money by accepting free pallets, purchasing the cheapest options available, or continuing to use damaged pallets past their safe lifespan. However, this penny-wise approach often proves pound-foolish when you calculate the total cost of ownership.

Low-quality pallets break more frequently, creating constant replacement needs and increasing the risk of accidents and product damage. The time spent by your team sorting, repairing, or working around damaged pallets represents hidden labor costs that rarely get factored into purchasing decisions.

More significantly, the insurance implications of poor pallet management can dwarf any savings from cheap pallets. If substandard pallets contribute to an accident or fire that generates even a single significant insurance claim, your premium increases over the following years will eliminate any initial savings many times over.

Best Practices to Reduce Pallet-Related Insurance Risks

The good news is that implementing proper pallet management practices isn’t complicated or prohibitively expensive. Here are actionable steps that can help reduce your risk profile and potentially lower your insurance costs:

Institute regular pallet inspections as part of your daily operations. Train employees to identify damaged pallets and remove them from service immediately. Create a simple color-coding or tagging system to mark pallets that need repair or disposal.

Maintain proper storage protocols by establishing designated pallet storage areas away from heat sources, with clear vertical height limits and adequate spacing for fire suppression effectiveness. Document these standards and ensure all employees understand them.

Invest in quality pallets appropriate for your specific use cases. Match pallet specifications to the loads they’ll carry and the handling equipment you use. Quality pallets designed for your operations last longer and perform more reliably.

Keep detailed records of pallet procurement, inspection schedules, and disposal of damaged units. This documentation demonstrates to insurers that you take safety seriously and actively manage these risks.

Train your team on proper pallet handling, inspection criteria, and storage requirements. When employees understand why these practices matter, compliance improves dramatically.

How Better Pallet Management Translates to Lower Premiums

When you proactively address pallet-related risks, you’re not just improving safety—you’re building a case for lower insurance costs. Insurance underwriters reward businesses that demonstrate robust risk management practices.

During policy renewal negotiations, you can point to your pallet management program as evidence of your commitment to loss prevention. Facilities with documented safety programs, regular inspections, and strong compliance records consistently receive more favorable premium quotes than comparable businesses without these systems.

Additionally, preventing accidents and claims through better pallet practices keeps your loss history clean. A claim-free track record is the single most powerful tool for negotiating lower insurance premiums across all your coverage types.

Moving Forward: Making Pallets Work For Your Bottom Line

Your pallets should be assets that support efficient operations, not liabilities that drain resources through insurance costs and accident-related losses. By recognizing the connection between pallet management and insurance expenses, you can take strategic action that protects both your employees and your financial health.

Start by conducting a comprehensive assessment of your current pallet inventory and storage practices. Identify immediate risks that need correction and develop a systematic approach to ongoing pallet management. The investment of time and resources will pay dividends through improved safety, operational efficiency, and reduced insurance costs.

Conclusion

Understanding the relationship between warehouse operations and insurance costs requires expertise that bridges both worlds. When you’re ready to optimize your pallet program with quality solutions designed to reduce risk and support long-term cost savings, consider partnering with industry leaders who get it.

Kole Pallet brings decades of experience helping warehouses implement pallet solutions that support both operational excellence and risk management objectives. By choosing quality pallets and following industry best practices, you’re not just making a purchasing decision—you’re making a strategic investment in your facility’s safety and financial performance.

Frequently Asked Questions:-

Q1: How often should I inspect pallets in my warehouse to reduce insurance risks?

- Daily visual inspections should be part of your routine operations, with warehouse staff trained to identify and remove obviously damaged pallets immediately. However, you should also conduct comprehensive formal inspections at least monthly. During these detailed reviews, check for structural integrity, protruding nails, cracks, missing boards, and overall stability. Document these inspections and keep records for at least three years—insurance companies often request this documentation during policy reviews or claim investigations. High-traffic operations or facilities using pallets for heavy loads may benefit from weekly formal inspections.

Q2: What’s the maximum safe height for stacking empty pallets in a warehouse?

- Fire safety guidelines generally recommend limiting empty pallet stacks to 6 feet or less, though this can vary based on your facility’s specific fire suppression capabilities and local fire codes. Stacks exceeding this height significantly increase fire spread risk and often violate insurance policy requirements. If you need to stack pallets higher for space efficiency, consider using proper racking systems designed for pallet storage, maintain at least 18-24 inches of clearance below sprinkler heads, and ensure adequate spacing between stacks. Always consult your insurance carrier and local fire marshal for specific requirements that apply to your facility.

Q3: Can switching to plastic or metal pallets lower my insurance premiums?

- While plastic and metal pallets are less flammable than wood, the impact on insurance premiums depends on multiple factors, including your overall risk profile, claims history, and the insurer’s specific underwriting criteria. Non-combustible pallets can reduce fire risk exposure, which may be reflected in lower premiums, especially in facilities storing highly flammable products. However, the premium reduction might not always justify the higher upfront cost of alternative materials. The best approach is to discuss your specific situation with your insurance broker and present a cost-benefit analysis that includes both the investment in alternative pallets and potential insurance savings over time.

Q4: What should I do if my insurance inspector cites pallet storage violations?

- Address cited violations immediately—most insurance companies provide a correction deadline, typically 30 to 90 days. Document every corrective action you take with photos, receipts, and written procedures. Common fixes include removing excess pallets from prohibited areas, reducing stack heights, increasing clearances around fire suppression equipment, and implementing a damaged pallet removal system. Once corrections are complete, request a follow-up inspection or submit documentation to your insurer. Failure to correct violations within the specified timeframe can result in coverage restrictions, premium increases, or policy cancellation. Use the citation as an opportunity to review and improve your entire pallet management program.

Q5: How do pallet-related accidents affect my workers’ compensation insurance rates?

- Pallet-related injuries directly impact your Experience Modification Rate (EMR), which insurers use to calculate your workers’ compensation premiums. Your EMR reflects your company’s claims history compared to similar businesses in your industry. Even moderate injuries from pallet accidents—like strains from handling damaged pallets or lacerations from protruding nails—create claims that remain in your EMR calculation for three years. Multiple claims or severe injuries can raise your EMR significantly above the baseline of 1.0, resulting in substantially higher premiums across the board. Preventing pallet-related accidents through proper maintenance and handling protocols is one of the most cost-effective ways to keep your workers’ compensation costs under control.